Algorithmic trading, also known as algo trading or automated trading, refers to the use of computer programs and algorithms to execute trades in financial markets. These algorithms follow a predefined set of rules and strategies based on criteria such as price, volume, timing, and other market conditions.

The primary goal of algo trading is to execute trades faster, more accurately, and at a better price compared to manual trading. Algorithms can also identify and exploit trading opportunities that human traders might miss.

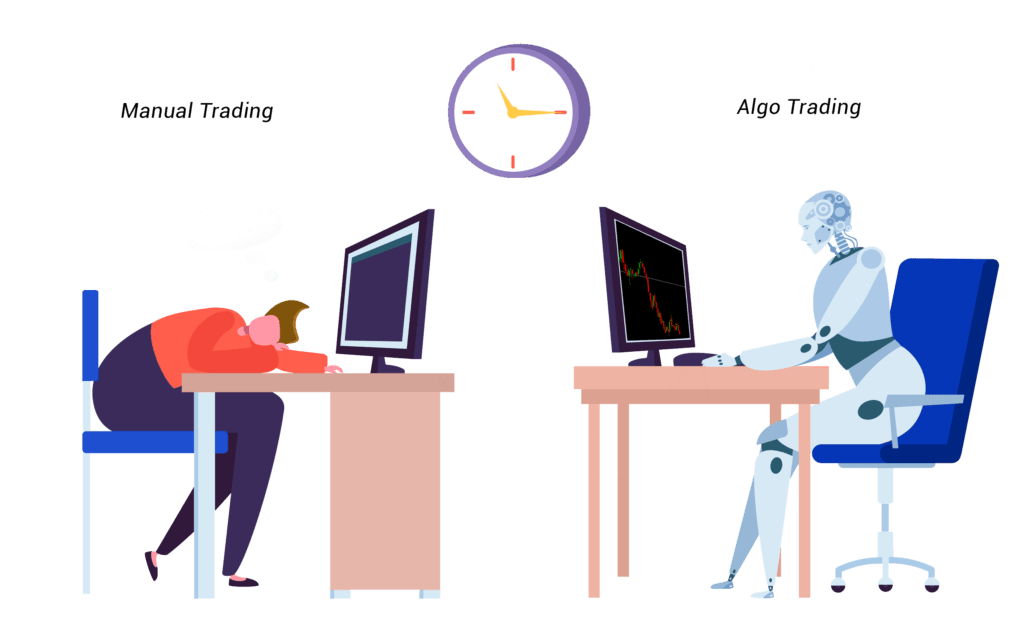

How is Algo Trading Different from Traditional Trading?

Here are the key differences between algo trading and traditional trading:

| Aspect | Algorithmic Trading | Traditional Trading |

|---|---|---|

| Execution | Fully automated; trades are executed by software. | Manual; trades are executed by human traders. |

| Speed | Lightning-fast execution in milliseconds or microseconds. | Slower execution due to human intervention. |

| Emotion | Completely emotionless; follows pre-set rules. | Influenced by human emotions like fear or greed. |

| Accuracy | Highly accurate and precise; minimizes errors. | Prone to human errors in decision-making. |

| Scalability | Can handle multiple trades and markets simultaneously. | Limited by human capacity and attention. |

| Cost Efficiency | Reduces transaction costs through automation. | May have higher costs due to slower execution and inefficiencies. |

| Market Monitoring | Continuously monitors markets 24/7. | Limited to human working hours and attention. |

| Complex Strategies | Can implement complex mathematical and statistical strategies. | Limited to simpler strategies due to human limitations. |

| Adaptability | Can be backtested and optimized for market conditions. | Harder to adapt quickly without significant effort. |

| Examples | High-frequency trading, arbitrage, pairs trading. | Swing trading, long-term investing, day trading. |

Advantages of Algo Trading

- Speed: Algorithms can analyze and execute trades much faster than humans.

- Reduced Costs: Lower transaction costs due to efficient trade execution.

- Emotion-Free: Eliminates emotional decision-making, leading to consistent results.

- Backtesting: Strategies can be tested using historical data before being deployed.

- Market Opportunities: Can identify and act on arbitrage or inefficiencies in real-time.

- 24/7 Monitoring: Constant market monitoring without fatigue.

Disadvantages of Algo Trading

- Complexity: Requires programming knowledge and understanding of financial markets.

- Over-Optimization: Backtested strategies may not always work in live markets.

- Technology Risks: Prone to software bugs, glitches, or system crashes.

- Lack of Human Judgment: Algorithms cannot account for unforeseen events or market anomalies.

- High Costs: Developing and maintaining algo systems can be expensive.

Applications of Algo Trading

- High-Frequency Trading (HFT): Extremely fast trades to capitalize on small price movements.

- Arbitrage: Exploiting price differences between markets or instruments.

- Market Making: Providing liquidity by placing buy and sell orders simultaneously.

- Pairs Trading: Trading correlated instruments to exploit divergence in price.

- Trend Following: Identifying and trading with market trends.

Algo trading is revolutionizing the financial markets by automating and optimizing trading strategies. Unlike Manual trading, which is slower and prone to human error, Algo trading allows traders and institutions to capitalize on opportunities in real time with precision and efficiency.

If you want to get started with Algo trading, learning programming languages like Python or platforms like MetaTrader and TradingView is a good place to start!